Stimulus Package – Maximising your cash flow boost

By now you are no doubt aware that the Federal Government has announced a stimulus package in response to the COVID-19 pandemic.

This is certainly welcome news. In order to maximise your stimulus payment, you need to understand how the measures will work. You may need to take immediate action.

- Who is eligible to receive a payment under the Boosting Cash Flow for Employers measure?

You need to meet ALL of the following criteria:

- A business entity;

- Aggregated annual turnover for the 2019 financial year under $50 million; and

- Employ workers in the period January 2020 to June 2020

- How do you apply for a payment?

There is no application process. Payments will be administered by the Australian Taxation Office and will be based on the lodgement of activity statements.

It is important to understand that payments will be made by the ATO as a credit to the activity statement account. Payments will not be paid in cash directly to eligible businesses.

- How much can you receive?

The maximum payment you can receive is $25,000; the minimum payment is $2,000.

- How is the payment calculated?

The calculation of the payment is based on the amount of PAYG withholding tax reported by the employer. The calculation will also depend on whether the employer reports monthly or quarterly.

Quarterly reporting

If you report PAYG withholding tax quarterly, you will receive the following payments:

- 50% of the PAYG withholding tax reported in the March 20 activity statement (subject to cap discussed below); and

- 50% of the PAYG withholding tax reported in the June 20 activity statement (subject to cap discussed below).

The payments above are subject to a COMBINED cap of $25,000. This means if you receive a $20,000 payment for the March activity statement the maximum payment you can receive for the June activity statement is $5,000.

Monthly reporting

If you report PAYG withholding tax monthly, you will receive the following payments:

- 150% of the PAYG withholding tax reported in the March 20 activity statement (subject to cap discussed below);

- 50% of the PAYG withholding tax reported in the April 20 activity statement (subject to cap discussed below);

- 50% of the PAYG withholding tax reported in the May 20 activity statement (subject to cap discussed below); and

- 50% of the PAYG withholding tax reported in the June 20 activity statement (subject to cap discussed below).

The payments above are subject to a COMBINED cap of $25,000. This means if you receive:

- a payment of $15,000 for the March activity statement

- a payment of $4,000 for the April activity statement and

- a payment $5,000 for the May activity statement

the maximum payment you can receive for the June activity statement is $1,000.

Point to note

We draw your attention to the payment calculation for the March 20 activity statement; this is calculated as 150% of the PAYG withholding tax reported. This is to provide a similar treatment to quarterly lodgers.

Interestingly, this could lead to a scenario where the payment made by the ATO for March exceeds the PAYG withholding tax reported. For example, if the PAYG withholding tax reported for March was $15,008 the ATO payment would be: $15,008 X 150% = $22,512.

- What can I do to maximise my stimulus payment?

If you are currently employing workers and your PAYG withholding tax is at least $25,000 per quarter (for quarterly reporters) or $8,333 per month (for monthly reporters) you should receive the maximum stimulus payment of $25,000 without doing anything.

However, we know a lot of small businesses do not fall into this category. For example, it is common for small businesses to pay working directors/owners a relatively small salary (or no salary) and distribute profits as dividends and trust distributions. While we would generally support this type of strategy it may result in a reduced stimulus payment…or even no stimulus payment.

Consider the following example:

Scenario 1 – Director paid dividends - no stimulus payment

• a small business company has a profit of $90,000

• the company pays income tax of $24,750

• the Director receives a cash dividend of $65,250

• the Director receives an income tax refund of $3,233

Outcome

Company: cash after tax $nil

Director: cash after tax $68,483

Scenario 2 – Director paid wages – maximum stimulus payment

• a small business company has a profit of $90,000

• the company pays wages to the Director of $90,000 over the next 4 months (starting from March)

• the company ends up with nil profit and pays nil income tax

• the company reports $33,348 in PAYG withholding tax to the ATO and receives a stimulus payment of $25,000

• the Director receives net wages of $56,652

• the Director receives an income tax refund of $11,831

Outcome

Company: cash after tax $25,000

Owner: cash after tax $68,483

Under scenario 2 the company would need to pay super of $8,550 which could be funded using the stimulus payment.

What is the definition of a business?

The definition of a business has been the subject of much debate in recent years. Until we see the legislation for the stimulus package we do not know how broadly or narrowly the term business will be defined.

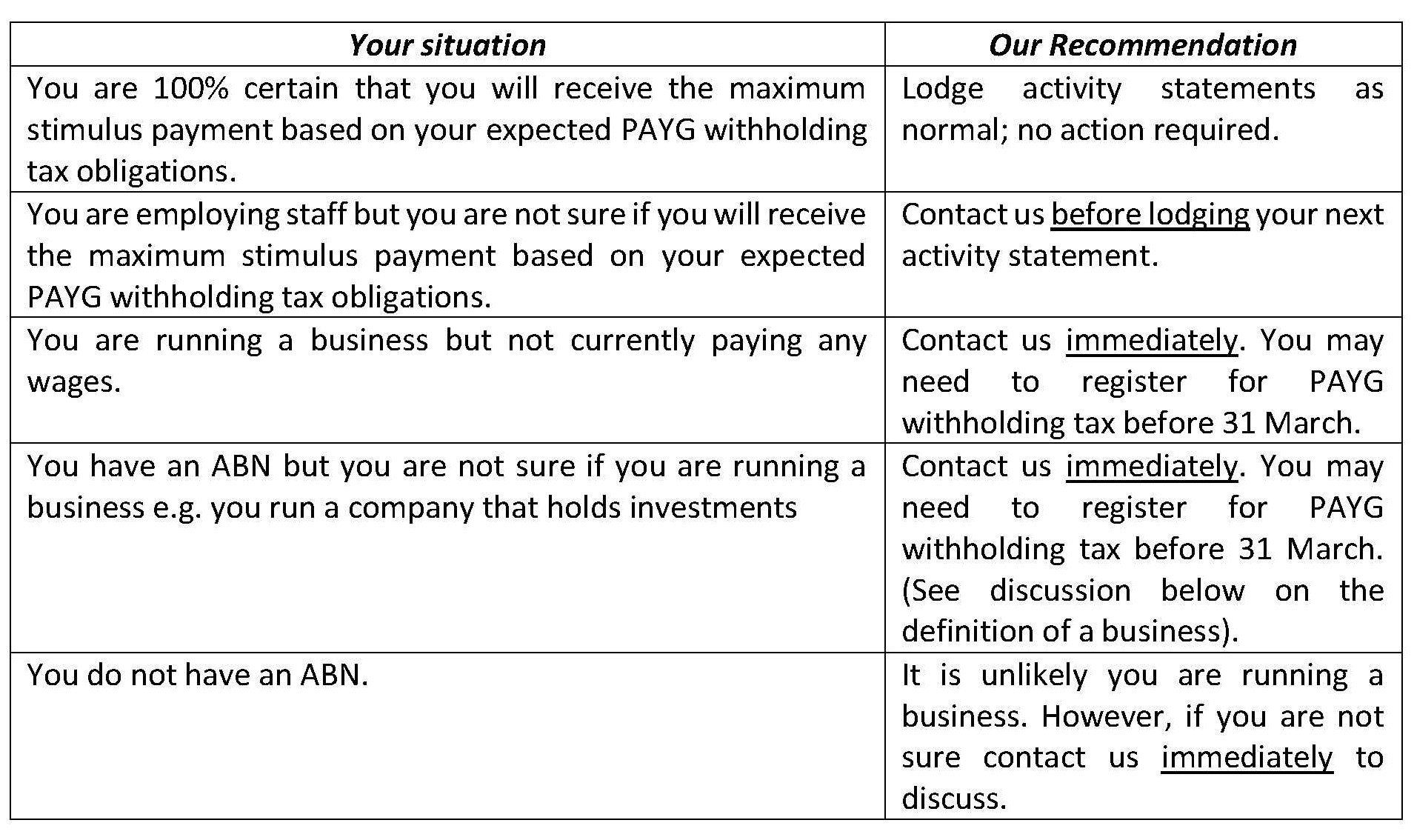

- OUR RECOMMENDATIONS – URGENT ACTION MAY BE REQUIRED

ALL CLIENTS

We strongly recommend that any outstanding taxation obligations (including activity statements, income tax returns, FBT returns etc) be finalised as soon as possible. It is not uncommon for the ATO to delay payments until outstanding taxation obligations are met. If you need any assistance in meeting your outstanding tax obligations, please do not hesitate to contact us.

Liability limited by a Scheme approved under the Professional Standards Legislation

All Rights Reserved | Quest Accountants Pty Ltd